Rentometer Mid-Year Report 2025: National Trends in Single-Family Rental Markets

Rentometer has published its latest Single-Family Rentals Report, covering the first six months of the year and highlighting rent prices and trends across the U.S.

The report focuses on median rents for 3-bedroom single-family homes in over 1,100 cities nationwide. Single-family home rentals house 41% of the U.S. renter population, and three-bedroom single-family homes are a preferred option for many families and investors.

As of this release, Rentometer has updated its methodology to report median values rather than averages, offering a better snapshot of the market. Our data set includes over 10 million new rental records annually, based on advertised asking rents, which serve as the foundation for our market reports.

Key Takeaways

- Rent Growth Picks Up Again But Remains Below the Inflation Rate and Average Wage Growth: Median single-family rents rose to $2,135, an increase of $36 or 1.7% compared to the same period last year.

- Midwest and Northeast Rents Grew the Fastest: Rents in the Midwest increased the most (+6.1%), followed by the Northeast (+4.6%) and the Pacific region (+3.1%). Median rents in the Rocky Mountain region rose by 1.1%, while rents in the Southwest remained flat.

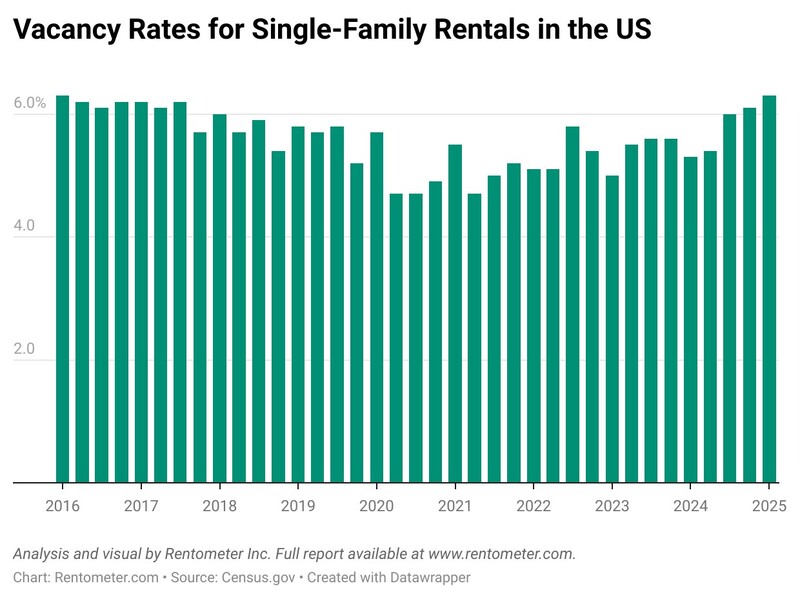

- Vacancies Hit Record Highs: Vacancy rates for single-family homes continued their upward trend in 2025, reaching 6.3% in the first quarter, the highest level since 2016.

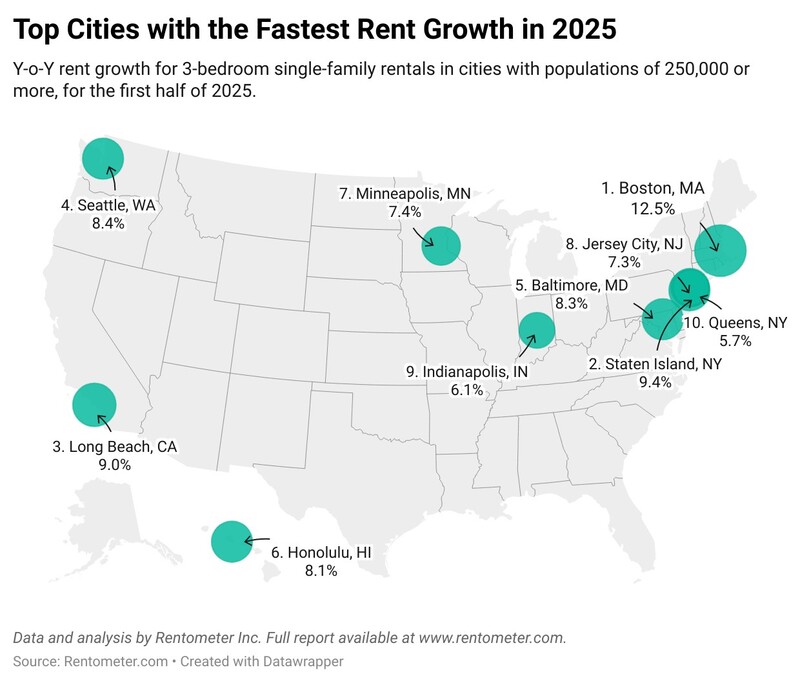

- Boston, MA saw the highest annual rent growth among large cities, with 3-bedroom single-family rents averaging $4,500—up 12.5% year-over-year. The increase was partly due to larger homes listed and a low rental inventory, making the data more sensitive to fluctuations. Staten Island, NY (+9.4%) and Long Beach, CA (+9.0%) followed.

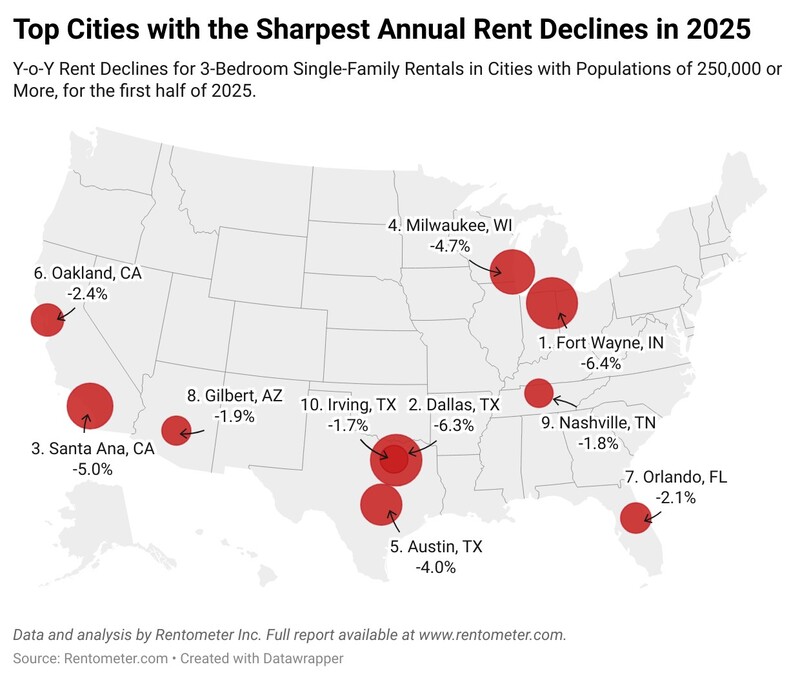

- Several large U.S. cities saw rents decline. Fort Wayne, IN recorded the largest year-over-year drop among cities with populations of 250,000 or more, with rents down 6.4%, followed by Dallas, TX (-6.3%) and Santa Ana, CA (-5.0%).

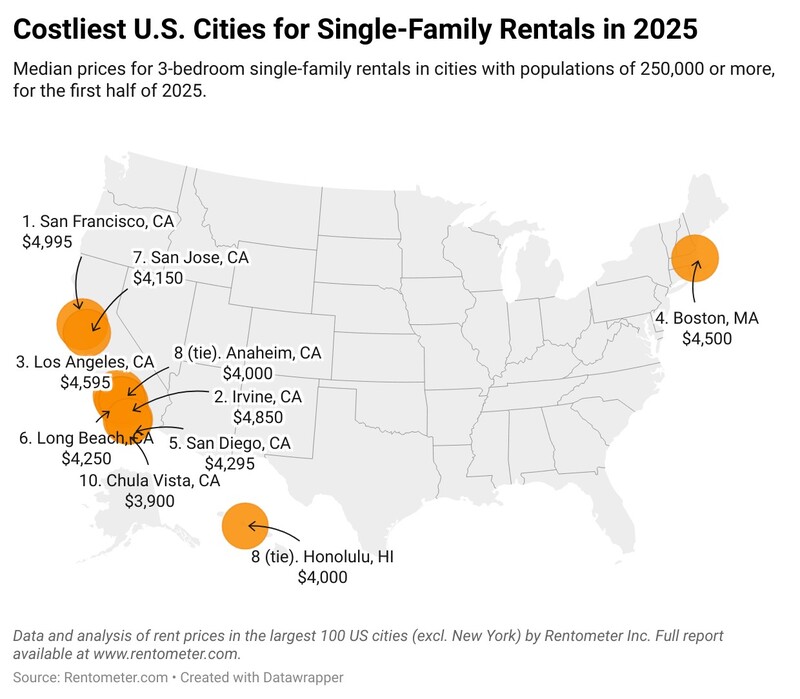

- Income Needed to Rent a 3-Bedroom Single-Family Home Tops $200,000 in Some Coastal Markets: Single-family rents have risen 39.5% over the past five years, compared to a 23% increase in median household income. As a result, the income needed to rent a typical SFR has surged—reaching nearly $200,000 in high-cost coastal markets like San Francisco.

Midwest Leads Rent Growth Rebound, But National Gains Still Trail Inflation

In the first half of 2025, median asking rents for single-family homes rose 1.7% year-over-year, reaching $2,135. While this marks a one percentage point increase over the 0.7% growth recorded in the first half of 2024, it still lags behind both the national inflation rate and average wage growth—indicating a slight decline in real rental income for investors and improved affordability for renters. Rent growth also remains well below the elevated levels observed during the first two post-pandemic years—and even below the typical 2–4% historical growth range—suggesting continued softness in the market and slower-than-usual gains for investors.

Regionally, the Midwest—the most affordable area for single-family renters—has seen a strong rebound. Median rent growth surged to 6.1% year-over-year, up from 3.4% last year, matching the pace seen two years ago and leading all U.S. regions.

In the Northeast, rents grew by 4.5% in the first half of 2025, nearly matching the pace from the same period last year. The Southeast has also picked up again, with rents rising 2.7% year-over-year, compared to just 0.3% growth in the same period of 2024. A similar dynamic played out in the Pacific region, where rent growth climbed to 3.1%, up from 1.6% last year.

The laggards remain the Rocky Mountain states and the Southwest, where rents grew by just 1.1% and 0.0%, respectively, compared to the first half of 2024.

Rent Growth Returns in Key Markets, but Some Cities See Price Corrections

The Midwest and Northeast regions recorded the highest increases in asking rents during the first half of 2025, and many of the top 10 cities with the fastest-growing rents are located in these areas. However, there were also notable pockets of growth along the Pacific Coast.

Boston, MA experienced the highest year-over-year rent growth among large U.S. cities, with asking rents for 3-bedroom single-family homes averaging $4,500, a 12.5% increase from the previous year. This surge was partly driven by a greater share of larger, higher-priced homes being listed and a tight inventory of single-family rentals, making local data more susceptible to fluctuations. While the average price per square foot has remained relatively stable, renters are facing higher total costs simply because the available homes are larger and come with a bigger price tag overall.

Other cities posting strong annual gains include Staten Island, NY (+9.4%), Long Beach, CA (+9.0%), and Seattle, WA (+8.4%), all reflecting continued demand in higher-cost coastal markets.

Asking rents for 3-bedroom single-family homes in Seattle reached an all-time high in the first half of the year, with the median price at $3,795. This increase is partly driven by a slightly higher share of larger homes being listed and a persistently tight inventory of single-family rentals within city limits. Despite the rise in rental prices, renting remains more affordable than buying—the estimated monthly mortgage payment for a typical 3-bedroom home in Seattle exceeds $5,000 when including taxes and insurance.

On the flip side, several markets experienced rent corrections, with Fort Wayne, IN seeing the largest drop among large cities (-6.4% YoY), followed closely by Dallas, TX, where advertised asking rents fell 6.3%. Dallas has been one of the epicenters of the build-to-rent industry, with over 10,400 new completions in the past five years—second only to Phoenix nationwide.

Vacancy Rates Surge to 6.3%—Highest Since Q1 2016

While median rents have slowly picked up again in 2025, they remain below historical growth levels. At the same time, vacancy rates for single-family rentals rose to 6.3% in Q1 2025 according to the latest Census report, up one percentage point from the same period in 2024—marking the highest level since the first quarter of 2016.

This rise in SFR vacancies is mirrored by higher vacancy rates in the apartment sector, which reached 8.2% in Q1 2025, as well as by declining home prices in some markets. These factors are expanding renter choices, increasing their bargaining power, and placing downward pressure on rents—particularly in oversupplied or cooling markets.

Vacancy rates have also been pushed higher by a record number of newly built single-family rentals, a sector which has attracted significant institutional investment over the past few years. According to a recent report by Point2 Homes, based on data from its sister company Yardi Matrix, a record 39,000 new single-family rental homes were delivered to the market in 2024, with an additional 101,000 units currently in various stages of development across the country.

Most of the built-to-rent inventory is located in the Southeast and Southwest—regions that over the past couple of years have experienced slower or even negative rent growth.

Despite rising vacancy rates, expanded rental options, and declining home prices in some parts of the country, these trends appear to signal a transitional phase rather than a cause for concern. While home prices have fallen in select markets, high mortgage rates and softer consumer confidence continue to keep many renters from entering the housing market. As a result, home purchase activity remains subdued, and renting continues to be the more practical option for a large share of households.

Despite Rent Growth Slowing, Renters Still Pay Significantly More Than Five Years Ago

While asking rents for single-family homes have risen more slowly than both average wage growth and inflation in the first half of 2025, the long-term increase remains substantial. Over the past five years, our data shows that advertised rents for single-family rentals have increased by 39.5%, compared to an estimated 23% rise in median household income during the same period (rising from $67,340 to an estimated $82,920 in April 2025).

This sharp price growth has been a boon for single-family rental (SFR) investors, attracting institutional capital to a segment traditionally dominated by smaller landlords. However, it has also placed considerable strain on renters, particularly in high-cost coastal markets.

To comfortably afford a three-bedroom single-family rental—defined as spending no more than 30% of gross income on rent—households need to earn well above the local median income in many cities. For example, in San Francisco, where the median rent is just under $5,000, a renter would need to earn nearly $200,000 annually—far above the city’s median household income of approximately $141,000.

In Irvine, CA, the income required to meet the 30% threshold is around $194,000, while in Los Angeles, it’s $183,000. Even more stark is Cambridge, MA, where median rents for a 3-bedroom home approach $6,000 per month, translating to a required annual income of $240,000—nearly twice the city’s median household income.

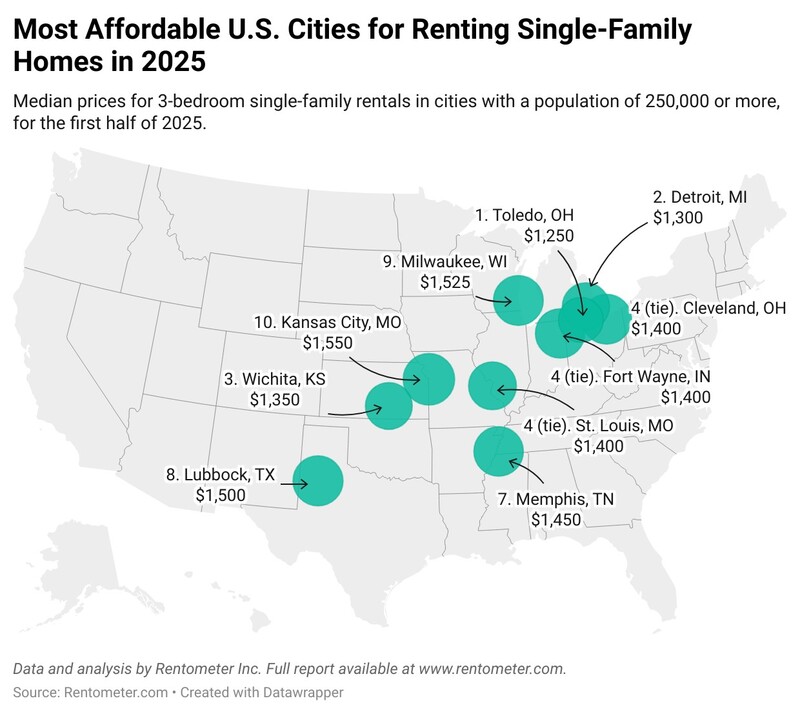

Renters looking for value will find it most often in the Midwest. Toledo is the most affordable large city in the U.S. to rent a single-family home, with median asking rents for 3-bedroom homes at $1,250. To comfortably afford that rent—using the recommended 30% of gross income rule—a household would need to earn about $50,000 per year, which is just above Toledo’s median household income of $49,700 (official 2023 figure, adjusted to May 2025 dollars).

While Toledo's rents are affordable, home prices are also low, making it one of the cities with the highest gross rental yields for single-family investors.

Single-family rentals are also relatively affordable in Detroit, MI (median asking rent: $1,300), though the income required to comfortably rent a 3-bedroom home—approximately $52,000—exceeds the city’s estimated median household income of $41,000 (official 2023 figure, adjusted to May 2025 dollars).

In Wichita, KS, where the median rent for a 3-bedroom single-family home is $1,350, the situation is more favorable. Renting comfortably would require an income of around $54,000, while the local median household income is over $66,000 (official 2023 figure, adjusted to May 2025 dollars), making Wichita the most affordable of the three cities relative to local earnings.

Rental Market Bifurcation: Budget-Friendly Heartland Cities vs. Coastal Luxury Hubs

Some of the most affordable places to rent a single-family home in the U.S. are small and mid-sized cities, particularly in the South and Midwest. Jackson, MS, with a median asking rent of $1,150, ranks as the most affordable mid-sized city in the country. For this report, mid-sized cities are defined as those with populations between 100,000 and 250,000, while small cities have fewer than 100,000 residents.

Other affordable mid-sized cities include Akron, OH and Columbus, GA, both with median rents of $1,200. Akron saw no rent growth compared to the first half of last year, while Columbus experienced only a 0.1% increase. Birmingham, AL also remains budget-friendly, with a median rent of $1,225, up 2.1% year-over-year. These modest rent levels and low growth rates suggest these markets remain accessible for renters and attractive for investors seeking affordability and stability.

While many mid-sized cities offer affordable housing, several coastal markets—particularly in California and the Northeast—rank among the most expensive places in the nation to rent a single-family home.

Cambridge, MA tops the list with a median asking rent of $6,000 for a 3-bedroom single-family home in the first half of 2025, up 7.1% year-over-year. In California, multiple cities exceed the $5,000 threshold, including Glendale, CA at $5,650 (up 10.2%), San Mateo, Costa Mesa, and Huntington Beach—all tied at $5,500 but with varying annual growth rates ranging from 7.8% to 10.0%.

Other high-priced markets include Berkeley, CA and Burbank, CA, with median rents of $5,000 and $4,997, respectively. While Berkeley's rents remained flat year-over-year, Burbank was the only city on this list to post a decline (-2.9%), suggesting potential price adjustments in some overheated areas.

In the Northeast, Stamford, CT also stands out with a median rent of $4,800, reflecting a 6.7% increase compared to the same period last year.

These cities highlight the sharp rent disparities across U.S. mid-sized markets—underscoring both the continued demand for rentals in coastal hubs and the financial pressure these rents place on households in high-cost areas.

Small cities—those with populations under 100,000—continue to offer some of the best deals for renters, particularly in the Midwest and South. At the same time, they also include some of the nation’s most expensive rental markets, especially in affluent California enclaves.

At the top of the affordability list is Flint, MI, where the median asking rent for a 3-bedroom single-family home is just $975, up 3% from last year. Other budget-friendly options include Waterloo, IA ($995, down 10%), Johnstown, PA ($1,050, up 20%), and Saginaw, MI ($1,100, up 10%). Despite recent rent increases in some of these cities, they remain accessible compared to national and regional averages.

Cities like Canton, OH and Decatur, IL continue to offer rents under $1,200, with Anderson, IN, Del City, OK, and Albany, GA hovering at or just below that mark. These markets are often overlooked but present strong value opportunities for renters and investors alike.

On the flip side, California dominates the list of the priciest small cities. Laguna Beach, CA tops the chart with a $8,000 median monthly rent for a 3-bedroom home, up 7% year-over-year. Other luxury hotspots include Beverly Hills ($7,450), Manhattan Beach ($7,250), and Newport Beach ($7,098)—all seeing slight annual declines, signaling a possible cooling in ultra-premium markets.

Miami Shores, FL, though not in California, is an outlier on the East Coast with a $7,000 median rent and a sharp 17% YoY increase, reflecting continued demand in high-end South Florida neighborhoods.

Also notable are Palo Alto ($6,900, +21%) and Calabasas ($6,825, +9%), both posting strong double-digit gains, which may indicate ongoing tech- and celebrity-driven rental demand. However, smaller cities like these often have limited rental inventory, making their markets more susceptible to price fluctuations and sharp year-over-year swings.

Rent Price Analysis in the Northeast

Asking rents in the Northeast increased by 4.6% year-over-year in the first half of 2025, and by just 0.2% compared to the second half of 2024. The pace of growth has remained relatively consistent with the same period last year, which saw a 4.8% increase. However, it is well below the elevated rent growth observed during the first two post-pandemic years—signaling a return to more typical, steady market conditions.

Of the markets tracked by Rentometer in the Northeast, 82% experienced rent increases, while 18% saw declines. Boston, MA led all large U.S. cities (population 250,000 or more) in rent growth, posting a 12.5% year-over-year increase in the first half of 2025. Several smaller cities also recorded double-digit gains, including York, PA (+22%), Niagara Falls, NY (+15%), and Harrisburg, PA (+14%).

Solid rent growth was also observed in Philadelphia (+5%), Pittsburgh (+3%), and Buffalo (+4%). Meanwhile, a few markets saw declining rents, including Yonkers, NY (-10%), Norwalk, CT (-5%), Trenton, NJ (-5%), and Linden, NJ (-4%).

Rent Price Analysis in the Midwest

The Midwest saw the strongest rent rebound in the first half of 2025, with median asking rents rising 6.1% year-over-year—up from 3.4% in 2024 and matching post-pandemic highs. Asking prices also saw a solid increase compared to the second half of 2024, rising by 2.9%. Despite the growth, the region remains the most affordable for single-family renters.

Toledo, OH stands out as the most affordable large city for renting a 3-bedroom home, with median rents at $1,250—just within reach for local households earning the area’s median income. Detroit and Wichita also offer relatively accessible rents, though Wichita stands out for having a local income level that comfortably exceeds what’s needed to rent, making it especially attractive for renters and investors alike.

Of the cities tracked by Rentometer in the region, 83% saw rent increases, while 17% experienced price declines compared to the same period last year. The largest rent hikes occurred in suburban areas such as Hamilton, OH (+22.3%), Livonia, MI (+17.3%), Grandview, MO (+17.0%), and Schaumburg, IL (+16.0%).

Among the region’s largest cities, Chicago, IL recorded flat growth, Columbus, OH saw a 4.2% increase, Indianapolis, IN rose 6.1%, while Detroit, MI was up 2% and Milwaukee, WI saw a 4.7% decline.

Rent Price Analysis in the Pacific Region

Median asking rents in the Pacific region increased by 3.1% in the first half of 2025, rebounding from a 1.6% growth rate during the same period in 2024. This also represents a modest gain of 1.5% compared to the second half of 2024.

Of the cities tracked in the Pacific region, 70% saw price increases, 21% experienced price declines, and 9% remained flat. The largest rent increases occurred in affluent small cities and towns in the Bay Area and Los Angeles County, such as Palo Alto (+21.3%), Redwood City (+15.7%), and San Gabriel (+14.3%). These spikes may reflect continued tech- and celebrity-driven rental demand. However, smaller cities like these typically have limited rental inventory, making them more vulnerable to price fluctuations and sharp year-over-year swings.

The region’s major cities posted more moderate growth, with the exception of Seattle, which saw asking rents rise 8.4%. In Los Angeles, rents rose 2.1%; in San Diego, 2.3%; in San Jose, 3.8%; and in San Francisco, a modest 0.9% increase was recorded.

Rent Price Analysis in the Southeast

After modest rent growth of just 0.3% in the first half of 2024, median asking rents in the Southeast rebounded in the first half of 2025, increasing 2.7% year-over-year and 3% compared to the second half of 2024.

However, this growth hasn’t been felt evenly across the region. Of the 412 cities and towns tracked by Rentometer in the Southeast, 59% recorded price increases, 15% remained flat, and 26% saw rent declines.

Florida stands out as an outlier within the region. After experiencing one of the strongest post-pandemic housing booms in the country, the state is now seeing signs of softening in both its rental and for-sale markets. Among the 119 Florida cities tracked by Rentometer, only 39% posted rent increases in the first half of 2025, while 13% were flat and 48% experienced price declines.

Tennessee is another state showing signs of market softening: 36% of the cities tracked by Rentometer—including Nashville—experienced rent price declines.

By contrast, rental markets in Alabama and Georgia have proven more resilient: only 15% of the cities tracked in Alabama and 23% in Georgia saw rent price declines, highlighting a sharper divide in market performance within the region.

Rent Price Analysis in the Southwest

The Southwest has lagged behind other regions in terms of median asking rent growth. In the first half of 2025, median asking rents in the region remained flat compared to the same period last year and rose just 0.3% from the second half of 2024. This marks the second consecutive year with no year-over-year rent growth in the first half—highlighting continued stagnation in single-family rental prices across much of the Southwest.

Of the 210 places tracked by Rentometer in the Southwest, 41% saw price declines—including some of the region’s largest cities such as Dallas, TX (-6.3%); Austin (-4.0%); Houston (-1.0%); Tucson, AZ (-0.3%); and Mesa, AZ (-1.1%). An additional 18% recorded flat or minimal growth of up to 0.5%.

Most major Texas cities experienced negative rent growth, including San Antonio and Fort Worth. Notable exceptions include El Paso (+0.8%), Arlington (+0.5%), and Corpus Christi (+5.0%).

However, rent trends were not uniformly negative across the region. Median asking rents increased in several large markets, including Phoenix, AZ (+2.7%), Oklahoma City, OK (+3.7%), Albuquerque, NM (+5.0%), and Tulsa, OK (+5.1%).

The Southwest has emerged as the epicenter of the build-to-rent movement, with Phoenix and Dallas leading the nation in new single-family rental deliveries over the past five years, according to Yardi Matrix. However, the impact on rent growth has varied across the region—while some markets have seen moderate gains, others are experiencing flat or even declining rents, reflecting a growing supply and shifting demand dynamics.

Rent Price Analysis in the Rocky Mountains Region

Median asking rents for single-family homes in the Rocky Mountain region increased by 1.1% in the first half of 2025 compared to the same period last year, with a similar change from the second half of 2024. This marks the second consecutive year of modest growth, following a 1.3% increase during the first half of 2024.

Among the region’s largest cities, median asking prices remained flat in Denver, Salt Lake City, Aurora, Henderson, and Reno. Las Vegas saw a modest 2% increase, while Colorado Springs experienced a stronger gain of 4%. The largest increase across the region was in Billings, MT, where median asking rents jumped 17% compared to the same period last year.

On the flip side, several Utah cities experienced notable price declines. Provo, UT saw a 5% decrease, while surrounding suburbs—including Orem (-10%), Herriman (-9%), Saratoga Springs (-6%), and Eagle Mountain (-6%)—also posted year-over-year drops. Most of these markets are part of the broader Salt Lake City metro area and may be experiencing a correction following years of rapid growth.

Explore the Full Nationwide Dataset

Dive into the full rent dataset powering this report. Use the interactive table below to sort, search, and explore key rent data for over 1,100 U.S. cities—all in one place.

Methodology

The methodology that Rentometer used to complete our nationwide rent price analysis is as follows:

- Geography: Rental markets in 1,100 U.S. cities across six regions.

- Property type: 3-bedroom single-family rentals (SFRs), regardless of bathroom count.

- Data Source: Analysis is based on advertised rent prices collected and updated between January 1st and June 30th for both 2025 and 2024.

- Metric: Beginning with this report, Rentometer is reporting median rents rather than average rents to better reflect typical market conditions and reduce the impact of extreme outliers.

- Analysis: Year-over-year comparison of rent data for the first half of 2025 (Q1–Q2) versus the first half of 2024 (Q1–Q2).

- Exclusions:

- Cities with fewer than 25 new or updated rental listings in any quarter were excluded.

- Rentals with advertised monthly prices below $500 or above $10,000 were excluded.

About Rentometer

Rentometer is a Boston-based company that has been providing investors and real estate professionals with rent estimates and comps for over 15 years. Our company collects and analyzes over 10 million new rental records each year, which form the basis of our market reports.

For over the past two years, Rentometer has closely tracked and reported on three-bedroom single-family home rentals. Single-family home rentals house 41% of the U.S. renter population, and three-bedroom single-family homes are a preferred option for many families and investors.

Rentometer was founded by two seasoned real estate entrepreneurs:

Mike Lapsley is a proptech veteran with over 25 years of experience in the rental housing industry. Prior to Rentometer, he was the CEO of RentGrow, a leader in automated resident screening systems, which was successfully acquired by Yardi Systems. Mike holds a BS in Business Management and Accounting from the University of Lowell.

Torrence C. Harder has over forty years of experience investing in entrepreneurial companies. He founded Harder Management Company, Inc., which has founded and ventured sixteen companies. Torrey holds a BA with Honors from Cornell University and an MBA with Honors from the Wharton School of the University of Pennsylvania.

Transform Data into Decisions with Rentometer

Rentometer provides hyperlocal, accurate rental data that helps you move forward with confidence. Make data-driven real estate decisions today!

Get Started