Texas Single-Family Rents Hit a Turning Point in 2025

After years of outsized growth, Texas’ single-family rental market has entered a clear correction phase.

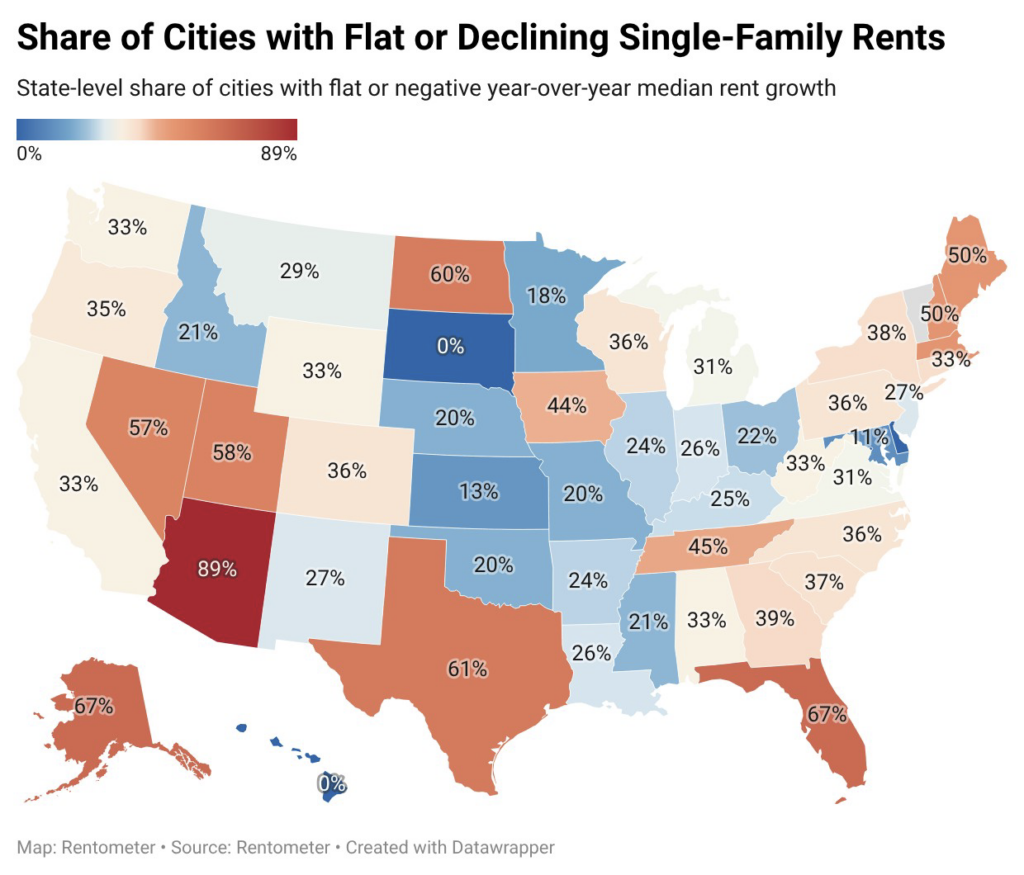

While the national median rent for a three-bedroom home held steady at $2,100 in 2025, Texas stood out as a key driver of the nationwide slowdown. A full 61% of Texas cities posted flat or declining rents, including all four of the state’s largest metros—marking a sharp break from the double-digit rent growth that defined much of the early 2020s.

While most cities posting flat or declining rents and only a handful of smaller markets continuing to see meaningful growth.

To show how uneven this shift has been, we created an interactive, color-coded map of Texas cities. The map displays year-over-year percentage changes in rents for three-bedroom single-family homes, while hovering over each city reveals its 2025 median rent.

Only Arizona, Florida, and Alaska recorded a higher share of cities with flat or declining rents. In contrast, neighboring states such as New Mexico, Oklahoma, Louisiana, and Arkansas saw flat or declining rents in fewer than 30% of their cities, underscoring how sharply Texas diverged from the broader region.

Stay connected

Get rental market insights delivered straight to your inbox.

Here is a deep dive into what the data means for Texas renters, investors, and homeowners.

Big Texas Metros: Declines Across the Board

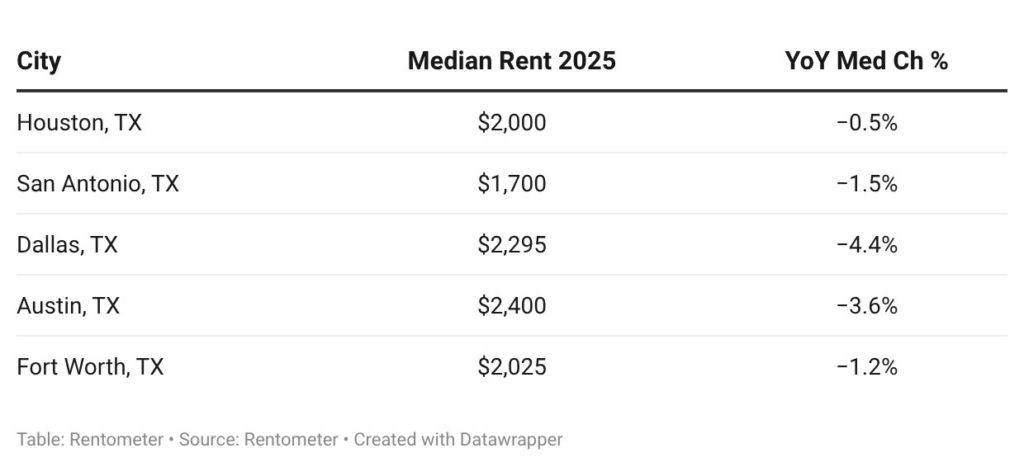

All five of Texas’ largest cities saw year-over-year rent declines for three-bedroom single-family homes in 2025:

Dallas recorded the largest decline among major U.S. cities, while Austin entered its second consecutive year of falling rents, confirming that the post-pandemic surge has fully unwound in the Texas capital.

For context, Austin rents are now meaningfully below their 2022 peak, marking one of the clearest examples of a Sunbelt market correction nationwide.

Suburbs and Exurbs: Not Immune Anymore

During the early 2020s, suburban and exurban Texas markets consistently outperformed urban cores. In 2025, that dynamic reversed.

Many high-growth suburbs posted sharp pullbacks, including:

- Round Rock: -6.5%

- Temple: -5.6%

- Longview: -5.3%

- Prosper: -4.6%

- Atascocita: -8.9%

These declines suggest that supply pressure has finally caught up with demand, particularly in areas that absorbed large volumes of new housing during the migration boom. Even fast-growing North Texas suburbs like Frisco (-0.4%), McKinney (-2.2%), and Allen (-4.2%) struggled to maintain pricing power.

Pockets of Strength: Mid-Sized Texas Cities Buck the Trend

While rent growth stalled or reversed across much of Texas in 2025, several mid-sized cities posted solid, above-average gains, standing out against the broader statewide slowdown.

Corpus Christi saw median rents for three-bedroom single-family homes rise 2.7% to $1,900, continuing a steady upward trend in a market supported by energy, logistics, and coastal employment. Amarillo followed closely, with rents increasing 3.5% to $1,650, reflecting tighter supply and more stable demand than in many of the state’s larger metros.

Brownsville also recorded a 2.7% increase, pushing median rents to $1,900 in 2025. Despite remaining relatively affordable by Texas standards, the city’s consistent growth highlights how smaller, less oversupplied markets are retaining pricing power even as larger urban hubs cool.

Among Texas’ largest cities, El Paso stood out as the lone exception, posting a 0.9% rent increase in 2025. While modest, the gain contrasts sharply with declines in Dallas, Austin, Houston, and San Antonio, reinforcing the increasingly hyper-local nature of rent performance across the state.

Together, these markets underscore a key takeaway from 2025: in Texas, rent growth hasn’t disappeared—it has shifted, concentrating in mid-sized cities where supply remains more balanced and affordability pressures are less acute.

Smaller Cities Are Carrying Texas’ Rent Growth

While much of Texas appears flat or down, the map also highlights clusters of green in smaller and mid-sized cities. Notable outperformers include:

- San Angelo: +11.7%

- Texarkana: +14.3%

- Abilene: +8.2%

- Beaumont: +6.7%

- Wichita Falls: +3.5%

These markets tend to share tighter supply conditions and more stable demand drivers, allowing rents to rise even as larger metros struggle.

What This Means for Investors, Renters, and Owners in Texas

The uneven performance across Texas cities in 2025 carries different implications depending on where you sit in the market.

For Investors: Selectivity Matters More Than Ever

The era of broad, market-wide rent growth in Texas is over. In 2025, returns were increasingly driven by city-level fundamentals rather than statewide trends. While major metros and fast-growing suburbs faced declining rents, several mid-sized markets continued to deliver steady gains.

For investors, this shift rewards:

- Hyper-local market selection, particularly in supply-constrained cities

- A focus on cash flow and operational efficiency, not just appreciation

- Caution in recently overheated markets where rents remain above sustainable levels

In short, Texas is no longer a “buy anywhere” story; it’s a pick-your-market carefully environment.

For Renters: Long-Awaited Relief in Major Markets

For many Texas renters, especially in large metros, 2025 marked a meaningful change in leverage. With rents flat or falling in cities like Dallas, Austin, Houston, and San Antonio, households gained more negotiating power than at any point in recent years.

This shift means:

- More options as competition among landlords increases

- Fewer aggressive rent hikes at renewal

- Greater flexibility to prioritize location, space, or amenities

However, renters in smaller and mid-sized cities where rents are still rising may face continued, albeit modest, pressure.

For Owners: Pricing Power Has Softened

For property owners, particularly in Texas’ largest metros, 2025 underscored a new reality: pricing power can no longer be taken for granted. With elevated vacancy rates and more housing alternatives available, pushing rents higher has become increasingly difficult.

Owners are now competing on:

- Property quality and maintenance

- Responsiveness and tenant experience

- Strategic pricing rather than automatic increases

In many cases, retaining good tenants has become more valuable than chasing marginal rent gains.

Stay connected

Get rental market insights delivered straight to your inbox.

LinkedIn

LinkedIn

Facebook

Facebook

Email

Email

Twitter

Twitter

Quickly evaluate current rents with QuickView™ Rent Estimates

Quickly evaluate current rents with QuickView™ Rent Estimates