2025 Annual Single-Family Rentals Report

Single-family rent growth in the U.S. has effectively stalled in 2025, marking a sharp shift from the rapid increases seen earlier in the decade. Rentometer’s 2025 Annual Single-Family Rentals Report highlights how this slowdown is playing out across more than 1,500 cities nationwide.

The analysis focuses on median advertised rents for three-bedroom single-family homes, the most common single-family rental configuration, within a sector that houses approximately 41% of the U.S. renter population.

Our dataset includes over 3.5 million new rental records each year, drawn from advertised asking rents, which form the foundation of Rentometer’s market reports.

Key Takeaways

- The median rent for a three-bedroom single-family home in the United States was $2,100 in 2025, remaining largely unchanged from the prior year.

- Single-family rental (SFR) rent growth slowed to a near standstill, a sharp shift from the elevated growth rates seen just a few years ago.

- Despite the slowdown, most cities avoided outright declines: rents were flat or modestly higher in the majority of markets, with small cities and suburban areas outperforming mid-sized and large cities.

- Regionally, the Pacific posted the strongest rent growth (3%), while the Midwest and Northeast—leaders in prior years—saw growth fall below 2.5%. Rent growth in the Southeast, Southwest, and Rocky Mountains was largely flat.

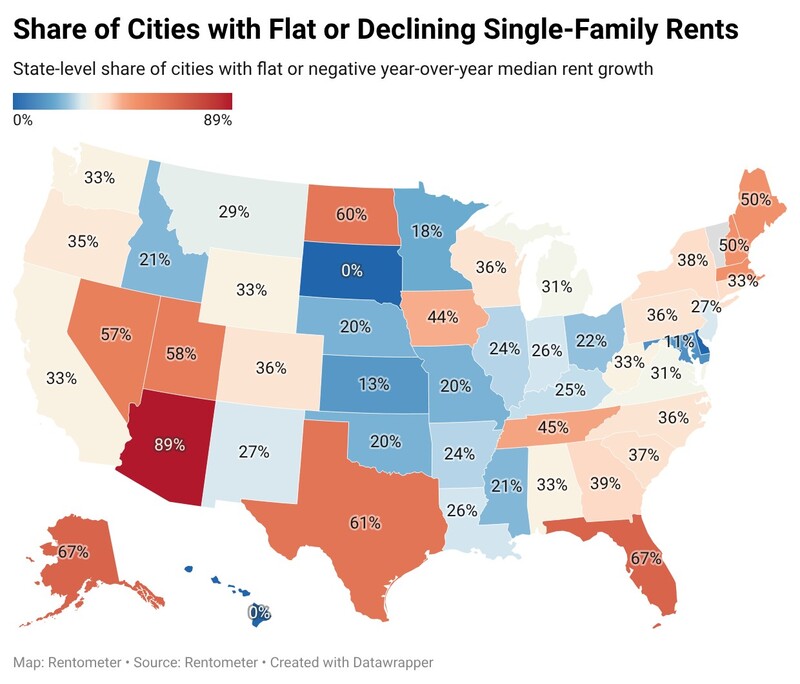

- At the state level, differences were pronounced. Arizona (89%), Florida (68%), and Texas (61%) recorded the highest shares of cities with flat or declining rents, compared with significantly lower shares in Illinois (24%), Indiana (26%), and California (33%).

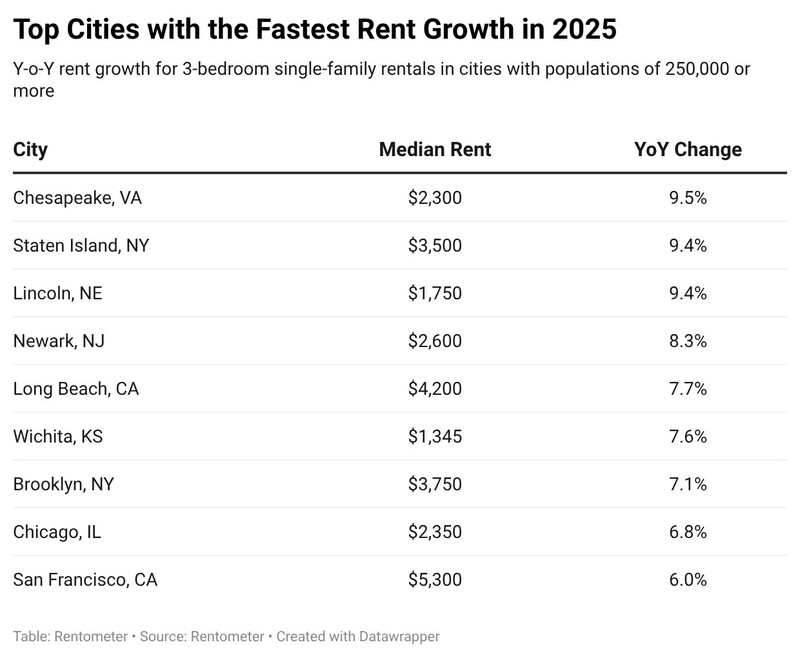

- Among cities with populations of 250,000 or more, Chesapeake, VA (9.5%), Lincoln, NE (9.4%), and Staten Island, NY (9.4%) recorded the highest rent increases. Chicago (6.8%) and San Francisco (6.0%) also posted solid gains in 2025.

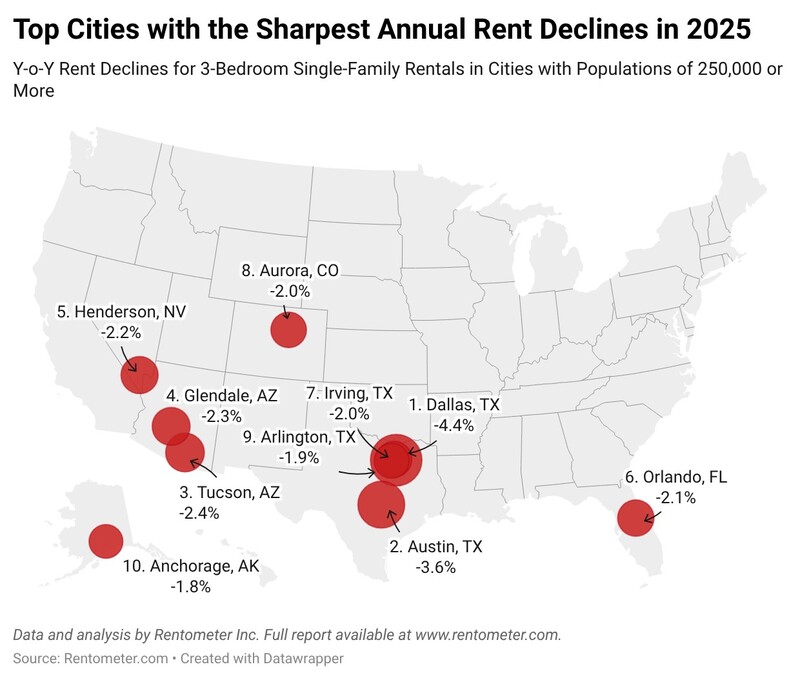

- Conversely, Dallas, TX (-4.4%); Austin, TX (-3.6%); Tucson, AZ (-2.4%); and Glendale, AZ (-2.3%) experienced negative rent growth. This marked the second consecutive year of falling rents in Austin and Glendale, signaling a market correction, while Dallas narrowly avoided a similar outcome after posting flat year-over-year prices in 2024.

2025 State of the SFR Market: The Great Stagnation

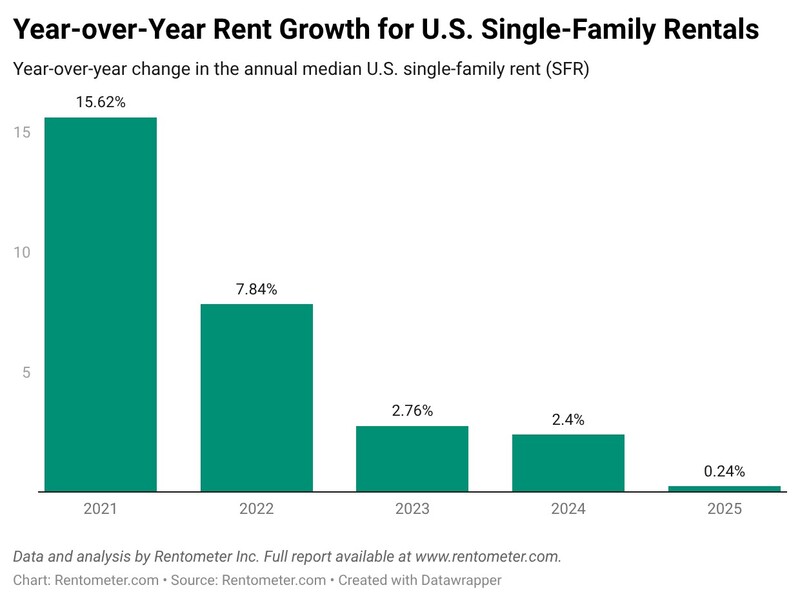

The single-family rental market, home to more than 40 million Americans, has shifted dramatically over the past three to four years. After posting strong year-over-year rent growth of 7.8% in 2022 and nearly 3% in 2023, gains cooled to 2.4% in 2024 and slowed further in 2025, with annual growth falling to just under 0.25%.

This near-stagnation masks a clear intra-year shift in 2025: rents rose by roughly 1.7% in the first half of the year before turning negative in the second half, effectively erasing earlier gains by year-end.

The national median rent for a three-bedroom single-family home stands at $2,100 in 2025, essentially unchanged from 2024, signaling a meaningful cooling in rental demand. While 59% of cities still posted positive gains, those increases were generally modest and more common in smaller suburban markets, which continued to outperform many large urban hubs.

Rent increases in 2025 have largely failed to keep pace with the broader inflation (CPI-U ranged between 2.3% and 3.0% for the first eleven months of 2025), meaning that for many investors, flat nominal rents have translated into a contraction of real income. Conversely, for households, this slowdown represents a significant breath of fresh air. As wage growth began to outpace rent hikes in 2025, the rental burden eased for millions of families, marking the first time in the post-pandemic era that renter purchasing power has meaningfully reclaimed ground from housing costs.

Regional Divergence and the Sunbelt Correction

The Pacific region recorded the strongest rent growth in 2025 (3%), leading the country not only in absolute rent levels ($3,295) but also in year-over-year growth. It was followed by the Midwest (2.4%), which remained by far the most affordable region in the country, with median rents of $1,735, and the Northeast (2.2%). The Midwest and Northeast, champions of rent growth in prior years, saw their growth rates roughly halve in 2025.

At the lower end of the growth spectrum, the Southeast ($2,000), Southwest ($1,995), and Rocky Mountains ($2,300) recorded largely flat rent growth.

Regional averages, however, mask significant variation beneath the surface, with the state-level picture defined by sharp contrasts. Arizona, Florida, and Texas are leading the slowdown. In Arizona, a striking 89% of cities reported flat or negative rent growth, while major Sunbelt hubs such as Austin (-3.6%) and San Antonio entered a second consecutive year of declining rents.

While Arizona and Texas were clear laggards in the Southwest, only a small share of cities in Oklahoma (20%) and New Mexico (27%) posted flat or declining rents. Even within Texas—where most cities experienced negative or flat growth, including major metros such as Dallas, Austin, Houston, and San Antonio—there were notable pockets of stronger performance, including Abilene, Beaumont, and Wichita Falls.

Supply and Macro Headwinds

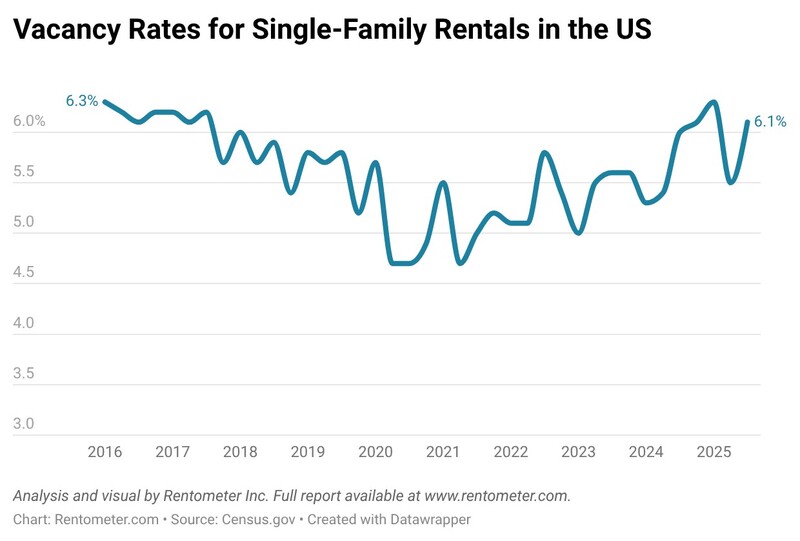

The current stagnation is driven by a "perfect storm" of supply and economic factors. Single-family vacancy rates reached 6.3% in early 2025, the highest level in nearly a decade. Although vacancies stabilized later in the year (6.1% in Q3 2025), they remain elevated relative to recent history.

Slowing job growth and weakening consumer confidence have weighed on rental demand across both the multifamily and single-family sectors. At the same time, a large wave of new apartment supply delivered over the past two years has provided a viable alternative for renters who might otherwise choose single-family homes, particularly those facing affordability pressures.

According to Zillow survey data, only about half of recent renters who moved out of a single-family detached rental transitioned into another single-family home, with the remainder shifting to apartments or other housing types.

As job growth slows and consumer confidence wavers, the SFR market has entered a phase of stabilization. For investors, the focus has shifted from riding the wave of market-wide appreciation to hyper-local asset selection and operational efficiency.

Laggard Cities: A Multi-Year Plateau (Not Just a 2025 Story)

City-level results show that the slowdown is not only a 2025 phenomenon. For several high-profile cities, the "rental boom" effectively ended in 2022 with little to no meaningful rent growth over the past three to four years, and in some cases, rents have moved lower since the 2022–2023 period. In other words, these laggard cities reflect a broader phase of stabilization (or correction) rather than a temporary year-over-year dip.

Jacksonville provides the most striking evidence of this freeze, with median rents remaining anchored at exactly $1,795 for four consecutive years. Los Angeles ($4,500) and Miami ($3,510) show similar profiles, failing to break past their 2022 ceilings. Notably, the January 2025 Los Angeles wildfires did not translate into a measurable city-level price jump, despite early concerns that displacement would drive a broad rent spike.

On the affordability end, Memphis also stands out for underperformance: rents were flat over the period and slightly below their 2022 level, a notably weaker outcome than the Midwest overall, which has been one of the strongest-performing regions over the past three to four years.

In several Sunbelt cities, the story is more pronounced: Austin and San Antonio are now meaningfully below 2022 rents, and Tucson has edged down from its 2024 level while remaining broadly flat versus 2022. Even Phoenix, after strong earlier growth, is effectively unchanged compared with 2022 and 2023 in this dataset.

Nashville tells a slightly different story. One of the most in-demand post-pandemic markets, the city still sits meaningfully above its 2022 level ($2,395 in 2025 versus $2,275 in 2022), reflecting the earlier wave of growth. But the more recent trend shows a clear cool-down: 2025 is marginally below 2024 and matches 2023, suggesting that Nashville’s run-up has transitioned into a period of consolidation at a higher price point rather than continued acceleration.

Denver follows a similar pattern. Rents are up versus 2022 ($2,950 in 2025 compared with $2,800 in 2022), yet the market has effectively moved sideways since 2023 and is slightly down year over year, consistent with stabilization after a strong earlier cycle. Colorado Springs appears steadier but with limited current pricing power: rents are only modestly above 2022 ($2,195 versus $2,150) and have been flat since 2023, with a small decline from 2024.

For these cities and a few more (see table below), the defining feature of 2025 is less about a single-year move and more about a multi-year lack of pricing momentum. This is a sharp contrast to the broader rental boom earlier in the decade and a signal that affordability ceilings and expanding rental alternatives are increasingly shaping outcomes at the city level.

Comeback Cities: Where Rent Growth Reaccelerated in 2025

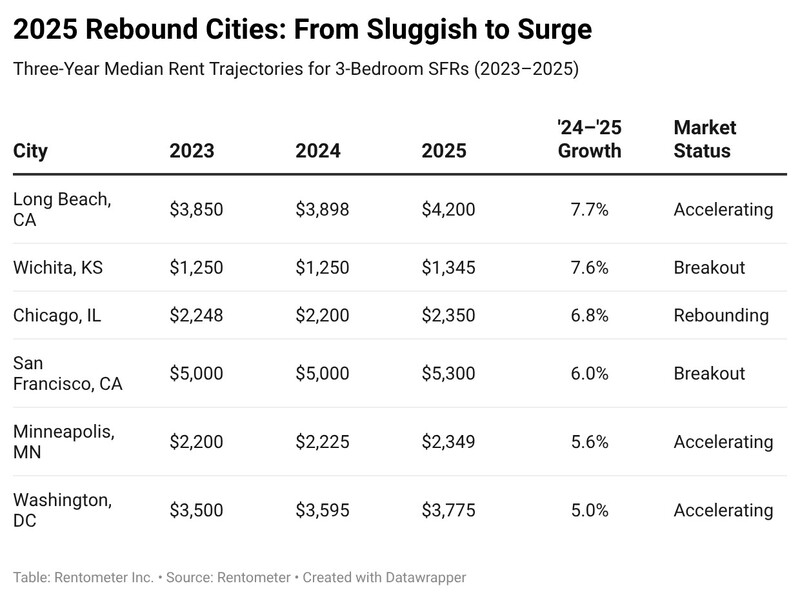

While much of the Sunbelt and Southwest struggles with oversupply, a select group of cities is defying the national stagnation and showed solid rent growth in 2025. These markets, which experienced sluggish or entirely frozen growth in 2023 and 2024, have suddenly broken their plateaus in 2025.

San Francisco’s renewed rent momentum in 2025 (after sitting flat in 2023–2024 in this dataset) lines up with a broader improvement in local sentiment tied to the AI cycle. Venture funding for AI companies in the San Francisco metro area raised a record $150 billion in 2025, reinforcing the perception that the city is reasserting itself as the center of gravity for the next tech wave.

This resurgence is most aggressive in Chicago, which not only recovered from its 2024 dip ($2,200) but surged to a new high of $2,350 and recorded a very strong 6.8% annual increase.

The momentum is equally visible in Long Beach, Minneapolis, and Washington, D.C., where growth accelerated sharply after a period of marginal gains. For investors, these cities are offering a rare pocket of rising yields. For renters, however, these rebounds signal that the brief window of urban price stability has officially closed.

The $4,000 Club: California’s Pricing Dominance

The high-end market remains almost exclusively a California story. Eight of the ten most expensive large cities in the U.S. are located in the Golden State, with San Francisco holding its position as the nation's most expensive SFR market at $5,300.

What stands out in 2025 is the divergent behavior among these premium hubs. While Los Angeles ($4,500) and Boston ($4,000) have hit a hard pricing ceiling with 0.0% year-over-year growth, others are seeing a renewed surge. Long Beach (7.7%) and San Francisco (6.0%) recorded significant gains, and after years of stagnation, high-income renters are once again competing for limited single-family inventory in core coastal markets.

Heartland Value Hubs

At the other end of the spectrum, the most affordable large cities in the U.S. are concentrated in the Midwest and the Great Plains. Toledo, OH remains the most budget-friendly market for a three-bedroom single-family home at $1,250, followed closely by Detroit ($1,300).

For renters and investors alike, these markets offer a starkly different value proposition. Markets like Memphis, Detroit, and Lubbock remained completely flat in 2025, offering predictable costs for tenants but limiting immediate upside for investors. However, even in the "affordable" category, there are signs of tightening. Wichita, KS saw a robust 7.6% increase, the second-highest growth rate among all cities analyzed in these two groups. This indicates that as coastal prices remain prohibitive, demand is trickling down into the nation's most affordable hubs, eventually creating new pricing pressure in the Heartland.

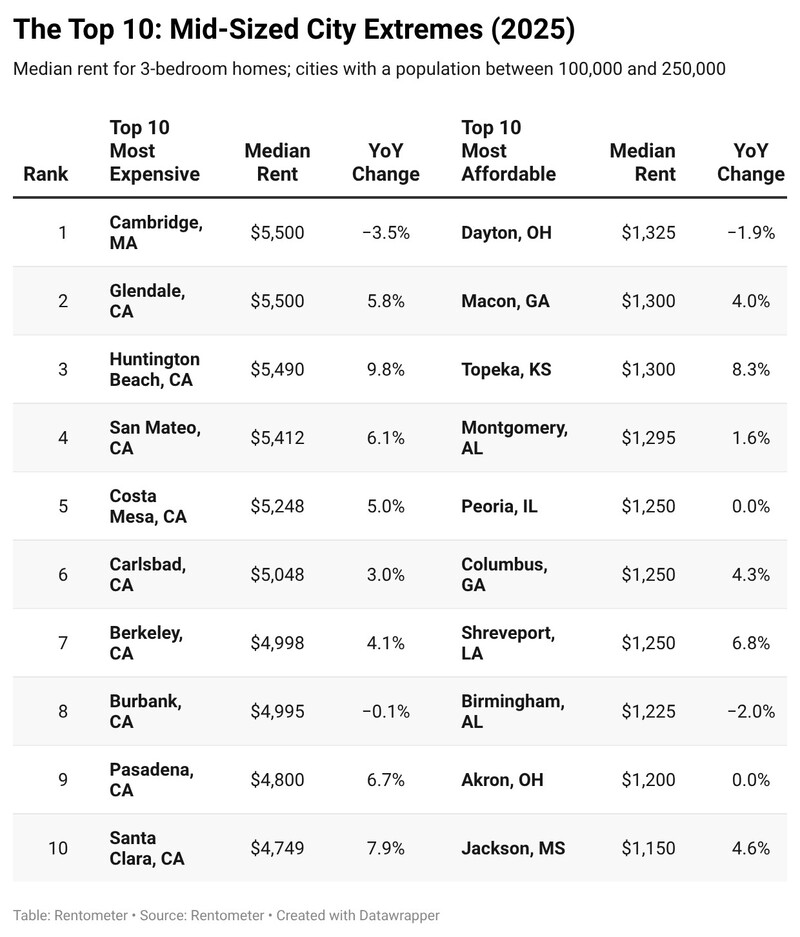

Mid-Sized Cities (100,000–250,000): Extremes Are Even More Pronounced

The large-city ranking shows that the most expensive single-family rental markets are concentrated along the coasts, especially in California, while the most affordable are largely located in the Midwest and parts of the South. The mid-sized city results reinforce this pattern, and in several cases amplify it: some mid-sized cities now post even higher median rents than the largest U.S. cities, while the most affordable mid-sized markets remain clustered near the bottom of the national rent distribution.

On the high end, the mid-sized leaderboard is dominated yet again by California coastal and near-coastal cities, alongside Greater Boston. Cambridge, MA ($5,500) and Glendale, CA ($5,500) top the list, with several other California markets close behind, including Huntington Beach ($5,490; +9.8%), San Mateo ($5,412; +6.1%), and Costa Mesa ($5,248; +5.0%). Notably, these mid-sized markets sit above the most expensive large-city market in the dataset (San Francisco at $5,300), underscoring how high-income, supply-limited submarkets can command premium rents even without major city population scale. Growth in this segment was also stronger than in many large-city markets, led by Huntington Beach (+9.8%), Santa Clara (+7.9%), and Pasadena (+6.7%), suggesting that pricing power remains intact in select high-demand pockets.

At the lower end, the most affordable mid-sized markets remain concentrated in the Midwest and Deep South, with rents ranging from $1,150 to $1,325. Jackson, MS ($1,150; +4.6%) is the least expensive city in this group, followed by Akron, OH ($1,200; flat) and Birmingham, AL ($1,225; -2.0%). Several others including Peoria, IL ($1,250; flat), Shreveport, LA ($1,250; +6.8%), and Topeka, KS ($1,300; +8.3%) show that affordability does not necessarily imply stagnation: a number of low-rent markets still recorded meaningful growth in 2025 even as the national SFR market overall approached a standstill.

Many of these affordable markets such as Shreveport, Birmingham, and Akron, along with affordable large Midwest hubs like Toledo and Detroit also rank highly in Rentometer’s recently published list of cities with the highest yields for single-family rental investors. In these markets, rents remain affordable while home prices are also relatively low, creating attractive cash-flow opportunities. In some cases, these cities are additionally offering upside potential through rising year-over-year rents.

Biggest Movers in 2025: Top Rent Gains and Steepest Declines

Even in a year of near-flat national growth, a small group of cities posted outsized rent increases. Chesapeake, VA (+9.5% to $2,300) led the nation, followed closely by Staten Island, NY (+9.4% to $3,500) and Lincoln, NE (+9.4% to $1,750). Several other markets also saw strong gains, including Newark, NJ (+8.3% to $2,600), Long Beach, CA (+7.7% to $4,200), and Wichita, KS (+7.6% to $1,345). Large coastal and gateway cities returned to growth as well, with Brooklyn, NY (+7.1% to $3,750), Chicago, IL (+6.8% to $2,350), and San Francisco, CA (+6.0% to $5,300) all posting notable increases.

On the downside, the sharpest pullbacks were concentrated in the Sunbelt, especially Texas and Arizona. Dallas, TX (-4.4% to $2,295) and Austin, TX (-3.6% to $2,400) recorded the largest declines, followed by Tucson, AZ (-2.4% to $1,850) and Glendale, AZ (-2.3% to $2,100). Other notable declines included Henderson, NV (-2.2%), Orlando, FL (-2.1%), and several additional Texas markets—Irving (-2.0%) and Arlington (-1.9%)—reinforcing the pattern of cooling across previously high-growth Sunbelt locations.

Explore the Full Nationwide Dataset

Explore the complete rent dataset behind this report. Use the interactive table below to sort, search, and analyze rent data across more than 1,500 U.S. cities—all in one place.

Methodology

The methodology that Rentometer used to complete our nationwide rent price analysis is as follows:

- Geography: Rental markets in 1,500 U.S. cities across six regions.

- Property type: 3-bedroom single-family rentals (SFRs), regardless of bathroom count.

- Data Source: Analysis is based on advertised rent prices collected and updated between January 1st and December 31st for both 2025 and 2024.

- Metric: Beginning with this report, Rentometer is reporting median rents rather than average rents to better reflect typical market conditions and reduce the impact of extreme outliers.

- Analysis: Year-over-year comparison of rent data for the full year of 2025 versus the full year of 2024.

- Exclusions:

- Cities with fewer than 25 new or updated rental listings in any quarter were excluded.

- Rentals with advertised monthly prices below $500 or above $10,000 were excluded.

About Rentometer

Rentometer is a Boston-based company that has been providing investors and real estate professionals with rent estimates and comps for over 15 years.

For over the past four years, Rentometer has closely tracked and reported on three-bedroom single-family home rentals. Single-family home rentals house 41% of the U.S. renter population, and three-bedroom single-family homes are a preferred option for many families and investors.

Rentometer was founded by two seasoned real estate entrepreneurs:

Mike Lapsley is a proptech veteran with over 25 years of experience in the rental housing industry. Prior to Rentometer, he was the CEO of RentGrow, a leader in automated resident screening systems, which was successfully acquired by Yardi Systems. Mike holds a BS in Business Management and Accounting from the University of Lowell.

Torrence C. Harder has over forty years of experience investing in entrepreneurial companies. He founded Harder Management Company, Inc., which has founded and ventured sixteen companies. Torrey holds a BA with Honors from Cornell University and an MBA with Honors from the Wharton School of the University of Pennsylvania.

Confident Rent Decisions Start with Real Market Data

Rentometer provides hyper-local rental insights that help you move forward with confidence. Move faster on the right deals today.

Get Started