Rent Analysis Guide

Setting profitable rental rates doesn’t need to be like throwing mud at the wall to see what sticks. Rentometer uses proprietary technology and data to provide a thorough rent comparison analysis in seconds. The market rent rates no longer have to be a mystery.

Market rent rates vary depending on the location, type of property, number of bedrooms, and amenities. To do the research on a specific area can take days and that is time that landlords, property managers, or real estate investors don't have.

Rentometer provides helpful tools for analyzing and determining the right rent for your investment or rental property by analyzing recent rental listings in the surrounding neighborhood.

Here are some of our top resources that will help you when setting your rent.

Table of Contents

Table of Contents1. Preparing to Purchase Investment Properties and Setting Rents

2. Characteristics That Make Up a High Rent Neighborhood

3. Questions to Consider When Setting Your Rent

4. Ways to Make Sure Your Property is Renting

5. Determining An Apartment Building's Value

6. Using Rent Comparison Data to Make Better Rental Decisions

7. How To Calculate The Amount You Can Make In Rent Each Month

8. Best Practices for Analyzing Market Rents in the Area

9. Are You Charging Your Renters the Right Price?

10. Don't Underestimate Your Rentals Potential

11. How to Choose the Proper Rent Price For Your Rental Property

12. Which Type of Residential Property Should You Manage?

13. Rentometer: Your Rent Setting Pricing Guide

14. Top 3 Landlord Mistakes on Charging Rent

15. Median or Average Rent? Which Should I Choose for My Rental Property?

Article 1.

Article 1.Preparing to Purchase Investment Properties and Setting Rents

Preparing to Purchase Investment Properties and Setting Rents Author: Laurie Mega

According to a BankRate survey conducted in July 2019, rental properties are now the most popular long-term investment in the U.S., surpassing the former investment of choice, stocks. This is particularly the case for those who aren't expecting to need their money for at least ten years. But there's a lot to consider if you're thinking of investing in a rental property. Here are tips you need to get prepared before you buy.

Define what you're looking for in a property

Identify the tenants to match.

- Get your money together.

- Find the best market for your goals.

- Get your management paperwork together.

You've closed on an investment property. Congratulations! Now it's time to figure out what kind of rent you should be charging.

Follow these steps to get to your ideal rent.

-

Understand your market with Rentometer

-

Calculate your margins.

-

Check the economic climate.

- Keep those rental laws in mind.

For a deeper dive, visit the full article.

Back to Top

Article 2.

Article 2.Characteristics That Make Up a High Rent Neighborhood

Characteristics That Make Up a High Rent Neighborhood

Author: Kyle Kroeger

Real estate is a fascinating asset class for investment. It’s the only asset class that you can get so locationally specific that you can invest not only by city but by neighborhood or even by street within a neighborhood. These types of decisions can have a significant impact on your rental rates, which will ultimately have an impact on your investment returns. Real estate investing starts with rental rates.

Discover the 6 key characteristics of a strong rental neighborhood.

1) School ranking:

Families are willing to pay a premium to be located in a district with the best in class school systems. As long as the schools and opportunities in a particular market or neighborhood are healthy, you should have a nice “floor” on your rental rates.

2) Transportation options:

This works well in urban environments where land is scarce, and parking is limited. This drives more people to use public transportation. In specific markets, public transportation is easier to get around any other option.

3) Job opportunities:

Look for neighborhoods close to large corporations and favorable job environments on the corporate side. Steady employment numbers will help support higher rental rates and longer-term rentals.

4) Restaurant/commercial/retail amenities:

Use commercial business trends as a neighborhood indicator for future rental price increases. As larger businesses move into an area, more people want to live close to these amenities. Watch your rental rates close to these areas and adjust accordingly.

5) Walkability:

Being able to walk to all the above locations like schools, restaurants, work, etc. is very important. Neighborhoods and markets that have good walkable flow will attract more demand.

6) Crime rate:

This is one of the easier ways to screen for high rent areas. Sometimes the perception that a neighborhood has terrible crime but does not could lead to rental opportunity. Do your research.

These 6 factors will help you identify strong rental markets in any city.

Read MoreBack to Top

Article 3.

Article 3.Questions to Consider When Setting Your Rent

Questions to Consider When Setting Your Rent

Author: Eva Hatzenbihler

Your success hinges on renting out the property rented at a rate that earns you a profit. But how do you know what rate the market will bear— and provide the desired cash flow to cover your mortgage and expenses?

These questions can help.

1) How does location affect rental rates?

You can't compare a property in a less desirable part of town to a property in a new development. In each location, you have a tenant base you need to consider, along with amenities in the area.

2) What's the historic pattern for the property's rent?

When you research a specific area, you want to look for past trends in rental prices. Rentometer is a rent evaluation tool that has trends. If the property you purchased has not had any significant updates; or new amenities introduced into the area; the property may not warrant an increase.

3) What are other property managers charging for rent in that area?

It's important to know what other landlords are charging in order to keep your rental rates competitive.

4) How safe is the neighborhood?

If your tenants don't feel safe, they may not stay in the neighborhood. Your rental rate in a less desirable area will naturally fall below the "average" rent for the property's type and size.

5) Is your property close to everyday public services?

The neighborhood's walkability plays an important role in how attractive it is to potential tenants. If basic public services are within a 5-minute walk from your rental, you will be able to charge more for rent.

The burden of operating costs can weigh heavily on any landlord's checkbook. There may be times when you allow a tenant to move in at a reduced rate for a set period of time.

When you set your rents, do your research first. There will always be a delicate balance of what you want and what the market can afford. Read on to see more questions to consider.

Read More Back to TopArticle 4.

Article 4.Ways to Make Sure Your Property Is Renting

Ways to Make Sure Your Property Is Renting

Author: Liz Boksanski

Whether you own or manage one rental property or hundreds of rentals across the country, you need to be able to set fair market rents confidently. If your rent is set too high, it can sit on the market and you will miss out on monthly rental income. And if the rent is set lower than the competition, simply put, you will leave money on the table.

Here are 7 ways to make sure your property is renting for market rate.

1) Find comps

Check local apartment listings using the local newspaper, use online apartment guides, or websites like Craigslist and Rentometer to get a feel for the “going rents”. Rentometer is an excellent resource to give you historical rent trends for the area

2) Stay informed

Economic activity is one of the key drivers of rental housing demand and it can impact the rental market in unique ways. Thriving or closing will affect your renter pool.

3) Check occupancy

Are the occupancy rates trending upward? Good! The stronger the desirability of a rental, or neighborhood, typically the higher the occupancy rate.

4 )Take a tour

Go on a couple of tours of other similar buildings/properties in the area. Get an idea for the condition of the property, the amenities, $/SF, etc.

5) Chat with agents

Local experts (property managers, brokers, agents, appraisers, and lenders) are especially good at identifying the drivers of housing supply and demand unique to your market.

6) Use rent per square foot

This allows you to encapsulate into a single number all the subjective variables of rent and provides you a basis for comparison across different units.

7) Check with the local housing association

They may provide about local rent levels – past, present, and future. This is especially important for real estate investors and developers.

Read More Back to TopArticle 5.

Article 5.Determining An Apartment Building’s Value

Determining An Apartment Building’s Value

Author: Bill Manassero

Properly underwriting the value of an apartment building is critical to finding and making great deals. Generally, a bank will use three different ways to assess an apartment asset’s value. Learn about the three ways and how they can lead to consistent cash flow and successful investment.

- The sales approach

- The replacement approach

- The income approach

The sales approach looks at other comparable properties and what they have recently sold at in the area. Like residential real estate comps.

The replacement approach looks at how much it would cost to create the building, or buildings, from scratch, given construction materials, labor costs, etc.

The income approach, however, has a very heavyweight in the value assessment because, after all, the bank is really investing in a business, not just a property.

When it comes to assessing the value of an apartment building using the income approach, there are a few key terms to know like ROI, Cap Rate and NOI.

NOI involves subtracting your total expenses from your total income. Let’s see how we arrive at both totals.

Add up all sources of income for the property for the year.

Items can include: Rents from the properties, coin-operated laundry machines, vending and candy machines, parking charges, any other income

Here’s a rundown of potential operating costs for the apartment complex: Property management charges, maintenance and repairs, trash collection, landscaping, taxes and insurance, utilities, and any other expense.

Also, the mortgage payment is not included in determining NOI.

To determine the market cap rate, you can do three different things: ask commercial brokers, research similar recently sold properties, ask local commercial lenders.

Suppose that we’re utilizing a cap rate of 10%.

So you can see how advantageous a higher NOI is to the equity and value of your property. So, it begs the question, “How do I increase my NOI?” The answer is simple: reduce expenses and increase income!

The great advantage of investing in apartments is that you can directly “force appreciation” and value by the way you manage the property and its finances.

Back to TopArticle 6.

Article 6.Using Rent Comparison Data to Make Better Rental Decisions

Using Rent Comparison Data to Make Better Rental Decisions

Author: Laurie Mega

Setting a good rent price for your property can sometimes feel like a shot in the dark. You have a general idea of what landlords are charging in your area, and you’re keeping up with that. But if you have a luxury two-bed, you don’t want to charge the same as the dated garden-level two-bed down the street, right? There may be factors you haven’t considered that could allow you to charge more.

Here are some tips to help you set the best rent price for your property.

Avoid Basing Rent off of Your Property Value

One way that a landlord could start to think about how much rent to charge is to base it off of the current value of the property. Using the 1% rule, depending on where you live, may deliver results that could be unreliable. That’s why factoring in your location is important, and understanding your local market is crucial.

Know Your Local Market

Where your rental property is located greatly influences the kinds of rent charged. Your state and city are good indicators for the kind of rents being charged. But it is more localized to understand how much rent an independent landlord can reasonably charge. It is at the neighborhood level that determines market value.

Pay Attention to Rent Fluctuations

Rent price is not a set-it-and-forget-it kind of thing. Average market rates can change from year to year. Even if you’ve already set your rent price, taking a look at rents in your market every year can help you assess whether or not you need to raise or lower rates to meet market demand.

Analyze Prices for Similar Properties

- Get the most accurate comps in your area to set a competitive rent price.

- Make sure, though, that you’re comparing apples to apples.

- Understand the Value of Your Amenities

Once you’ve calculated your rent based on value, location, and market, think about the amenities your property offers and how they make your apartment stand out. Compare your rental unit to those with similar amenities, such as a doorman, an onsite gym, or laundry in the unit. You’ll probably find that units like these get to charge a little more.

Analyze Rent Comparison Data

To set a good rent price for your property, you’ll have to do your homework. And you’ll have to consider everything: location, size, amenities, and market data. Pay attention to the market and similar properties, set your price, and regularly adjust and tweak.

Find a good rent comparison tool, use neighborhood comps to set your rent price, keep up-to-date on rent pricing in your area, and keep your property competitive and profitable.

Back to TopArticle 7.

Article 7.How To Calculate The Amount You Can Make In Rent

How To Calculate The Amount You Can Make In Rent

Author: Eva Hatzenbihler

Any investment property owner will tell you there's more to the game than sitting back and collecting the rent! Handling the responsibilities of property management – dealing with troublesome tenant issues, risking your assets on behalf of tenants you likely don't know, and taking care of the property's maintenance requirements – can take a toll. That's why it's essential to protect both your sanity and your asset with a monthly rent payment that's fair and accurately covers your actual burden.

Three factors to consider when figuring out how to calculate the amount you can make in rent each month.

1) Know your numbers

Before you purchase the rental property, you need a clear picture of both upfront investment costs and any recurring expenses. When you buy a property to rent, you need to see cash flow from rental income to cover recurring expenses, fund a maintenance reserve, and some acceptable profit increment.

2) Compare Similar Homes – In Similar Areas

Comparing the home prices in areas similar to where you are considering a property purchase can better understand the local rental market and if you are above or below what the market with bare. You'll also get a better idea of standard amenities – such as driveway, garage, off-street parking – on offer with other rental properties. A quick search on a real estate listing site will show you the details about nearby properties.

3) Use A Rent Calculator

A rent calculator is a handy tool to compare your monthly rental price to other available properties in the immediate area. Rentometer supplies easy-to-use, comprehensive resources for property managers, landlords, and tenants – find out at the touch of a button if you're charging (or paying) too much or too little by comparing your rent with other local properties.

No matter how you approach your investment in a rental property, reliable knowledge to ensure that you're charging or paying an appropriate price is key to fostering good relationships between landlords and tenants.

Back to TopArticle 8.

Article 8.Best Practices for Analyzing Market Rents

Best Practices for Analyzing Market Rents

Author: Eva Hatzenbihler

Whether you're looking to rent your property, it's a good idea to analyze the rents in the area. Understanding what the market is like before getting too excited over a price will save you a lot of time and anguish.

The following are some of the best practices when it comes to analyzing market rents in a neighborhood or city.

Consider Location

The more you have around you, the higher the rent. This makes sense because people want to be around schools, public transportation, shops, entertainment, restaurants, and other amenities.

Property Factors

When looking at rental prices, you need to remember the factors that go into the rent amount. Single-family homes are often more expensive than apartments. Properties with more bedrooms, baths, square footage, and bigger lots have higher rent prices, as do those that are newer, have upgrades, and many amenities nearby.

Vacancies

A vacancy is a significant factor in property rental prices. When there is a long time between renters, the rental rate usually decreases to attract more people to rent the property as soon as possible. Watch for transient areas.

Purchase Price

The goal is to pay off the property as soon as possible. This is done by offering the property for a rent amount that will not only bring in a renter but also pay as much of the loan principal as possible.

Use Rentometer for Help with Analyzing Market Rents in Areas

Rentometer is a tool that many renters and landlords use to gauge the going rental rate in specific areas. It does all the work for you when it comes to comparing different properties, cost of living for neighborhoods, and the location.

Back to TopArticle 9.

Article 9.Are You Charging Your Renters the Right Price?

Are You Charging Your Renters the Right Price?

Author: Eva Hatzenbihler

There are two goals of any property manager or owner.

• You want to get highly qualified renters in your rental space.

• You want to be sure that you used the right rent estimate.

There are likely thousands, if not more property managers and owners that are undercharging their renters.

The fact is that property reports can only deliver so much information. A rental meter that is part of a rental listing app can provide much more focused data to help you set your rental price without undercharging your renters.

Are You Charging Your Tenants The Right Rental Rate?

What Most Landlords Do to Set Rent Rates

If you're a self-managing landlord, you often pick a rate that will give you a little cash flow, while covering your mortgage, insurance, and taxes. You may also look at local listings on Craigslist or in the newspaper to see what other landlords are charging. The problem comes when you get comfortable with a rate but don't realize you could be charging more, or maybe you're not reaching the right tenants because you are charging too much.

Property Management Companies Have a Little Advantage in Setting Rental Rates

Property management companies have a small segment within the properties they manage to test market rents and analyze what's hight or low. This gives them a slight advantage.

There is a Balance

Finding the perfect balance between not undercharging your renters and not overcharging yourself out of the market can be difficult without the right rent prediction tool.

Of course, no one wants to see their property sitting on the market vacant for months, but on the other hand, shortchanging yourself by not charging enough can also be just as tragic.

Data is king when it comes to ensuring that your rent is in line with what is happening in the rest of the area.

Accomplish More

When you have the right rental property app working for you, you can accomplish more with better results. Information at your fingertips can help you to make informed decisions in a fraction of the time. It can also help you to manage your properties more accurately. It is a win-win situation.

The right rental app will ensure that you are not undercharging your renters and do so much more. Don't waste any more time crunching numbers get it all done for you with an easy to use an app.

Back to TopArticle 10.

Article 10.Don't Underestimate Your Rentals Potential

Don't Underestimate Your Rentals Potential

Author: Eva Hatzenbihler

One of the biggest mistakes new landlords make is underestimating the rental potential of their property. Often new landlords are so eager to get tenants in their property, that they undervalue their rental in the listing.

Rule of Thumb

By looking at online rental listing services, they can get a reasonable estimate of what other property owners in the area are charging. This is a broad rule of thumb. But, they are lacking essential data and are not comparing apples to apples. When you compare actual rents, you need to consider the building, the number of bedrooms, and a similar location.

A Better Way to Boost Rental Income

Most property owners buy a rental property intending to produce positive cash flow by earning more income each month than they spend on expenses. Unless you’ve done your homework, many landlords start with what the previous owner was charging as a base. Often there is a reason that owner decided to sell, and it more than likely had to do with a lack of cash-flow.

Using average neighborhood rent data is the better way to set your rental price than basing it on chance or what a previous owner charged.

Why Do Landlords Short Change Themselves?

New landlords are eager. They want to get the property rented, and they want to do it quickly. Of course, getting qualified tenants in your rental should be a priority, but not at the cost of shortchanging yourself.

Offering a lower than average rental price may not be the best way to attract the highly qualified tenants that you want in your building.

A better way to do things to ensure that you are fair to all parties, including yourself, is to use a rent prediction tool to get a better idea of precisely what the value of your rental is. A rent estimator can make it easy to determine what a fair market price is for your rental property.

Keep Other Expenses in Mind

One issue new landlords have is miscalculating the expenses. Again in most selling reports, the agents give buyers the information provided by the sellers. Try to work with actual numbers as often as possible to avoid a loss in cash-flow.

A $20 Savings

Once you have determined what the average neighborhood rent is, and what you need to cover all of your monthly expenses, you can adjust your rental price by as low as $20 to attract tenants. Offering a small discount is the way to get the right tenants in your rental.

You can use the rent estimate and rent predictor as a guideline for budgeting and investing in future renovations for your rental. Any landlord can benefit from having easy access to the information that helps them to make crucial decisions.

Before you rent, be sure you check the average neighborhood rent. Don’t underestimate the value of your rental. Get the tool that can make property management more effortless.

Back to TopArticle 11.

Article 11.How to Choose the Proper Rent Price For Your Rental Property

How to Choose the Proper Rent Price For Your Rental Property

Author: Stephen Fox

In the real estate rental business, learning to choose the proper rent price for your property can make the difference between success and failure. Charging too little can eliminate the profit potential, while charging too much might make the property unattractive to potential tenants.

If you're not sure what to charge for rent, here are six factors you'll need to take into account.

1. Competition Helps Determine How Much Rent to Charge

See what other landlords are charging for homes and apartments that match your properties in terms of amenities and size.

One way is to check the rental listings on Craigslist. You can also go over your local newspaper. Both of these will help you determine the going rent in your area.

2. Amenities Help Choose the Proper Rent

The rent you charge shouldn't be standard unless the units are similar. Make sure you charge rent based on how desirable the unit is. As a guide, you should set the rent based on the following factors:

- Square Footage. A 700 square foot one bedroom is less desirable than a 1,000 square foot one bedroom.

- View. Apartments with beautiful views are more appealing.

- Layout. Apartments with a railroad-style are less desirable than those with other layouts.

- Updates. Units with hardwood floors, updated appliances, and other amenities are more desirable.

- Floor Level. Apartments with raised floors are more appealing.

Other things that tenants often look out for include:

- Balcony or similar spaces

- Safe Parking

- Generous, clean space with roomy cupboards

- Good, safe location

- Modern bathrooms and kitchens

- Plumbing for wet surfaces

- A shower option

3. Diamonds are Forever, Rent Isn't

The rental market is dynamic. What you charge now won't be the same as what you'll charge later. As such, you must continuously look at the market and adjust the rent accordingly. For example, the demand may spike in the summer because families are trying to move before starting a new school year.

Likewise, when the economy is bad, the demand for rentals may skyrocket, as people may no longer be able to afford homes.

As a general rule, when there's less demand, lower the rent. When there's a greater demand, charge a higher rent. Try to keep your tenants in mind when increasing rent. Dealing with an eviction is never a fun process. You must find a rental amount that's suitable for both you and your tenants.

4. The Right Rent is Attractive to Tenants

How many calls are you receiving on advertised properties? If you receive fewer calls, you may need to lower the rent prices. On the other hand, if you receive many calls on properties advertised, you may need to adjust the rent prices upwards.

Remember, prospective clients may not want to see your property if your apartment does not have the amenities or location to back up the higher rent. They might also assume that something is wrong with your property if your rental is priced too low for the area.

You'll need to find the perfect price point to succeed as a landlord.

For the last two success factors, click read more

Back to TopArticle 12.

Article 12.Residential Property Management Homes, Condos, or Apartments —Which is the Type of Property Should Your Manage?

Residential Property Management Homes, Condos, or Apartments —Which is the Type of Property Should Your Manage?

Author: Rentometer Content Team

If you are involved in the property management game, you know many moving parts come into play during any given week or month. You deal with everything from tenant screening and placement, rent collection, maintenance, and even evictions, all while balancing cash flow to meet expenses and staying on top of tenant requests and legal requirements.

These demands stack up quickly and can get complicated unless you develop reliable systems to stay on top of the workload. While many property managers seem to fly by the seat of their pants, one reliable success strategy involves choosing a property type that suits your skillset and lifestyle.

Maybe you’re an “accidental landlord” who never planned to be a property manager. Perhaps you are just entering the rental investment market and need to get your arms around all the obligations that come with managing a rental property. When you understand how the property management load varies with different property types, you can decide where you’re most likely to thrive in the business.

Pros and cons of managing homes, condos, or apartments

Single-family home property management

Single-family homes are stand-alone properties that you rent out to a family or similar household group. Single-family homes are the most popular housing types for rental property investors. Some property managers find them easy to manage.

Pros:

Tenants are usually interested in a long-term commitment. You won’t have to find and screen new tenants and fix up the property as often.

The households its resale value. A well-maintained house in a low-crime neighborhood rarely goes down in value. If you hold the property for a few years or more, you’ll often see steady appreciation.

Lower property taxes. Single-family homes enjoy lower tax rates than commercial or industrial rentals.

Lower maintenance costs. When you rent to a well-screened, responsible individual or family, you typically handle fewer maintenance issues, as this type of tenant often takes care of the property as if it was their own.

Cons:

Vacancies reduce returns. When a tenant moves out of your single-family property, you are 100% vacant until you find a new tenant. That means no rental income to offset your payments for the mortgage and utilities.

Higher cost of entry. Single-family homes cost more upfront because they hold their resale value. As a rental owner, you have a larger downpayment than buying as a personal residence.

Apartment building property management

Apartment buildings or multifamily units house numerous individuals or families in separate units under a single roof. Apartment buildings are usually located in urban areas and suburban areas. Many property managers find it easier to manage more doors under one roof instead of individual houses.

To see the pros and cons of apartment buildings, condominiums and townhomes click read more.

Back to TopArticle 13.

Article 13.Rentometer: Your Rent Setting Pricing Guide

Rentometer: Your Rent Setting Pricing Guide

Author: Rentometer Content Team

It’s no secret that you need to charge an appropriate rent to run your rental property profitably. If your rate is too high, the property may take longer to rent. You know that a vacant property does not generate rental income! With a rate that’s too low, you might leave rental income on the table. Doing so will ultimately put a damper on your property’s potential profit.

3 rent-setting tips for your property

Collect data

Your first order of business is to compile and evaluate rents being charged locally, especially in your property’s immediate area. The basic DIY approach involves a survey of rental listing sites to gather comps and compile that data. Most landlords then create a spreadsheet, which can involve a significant investment of time, and may not be complete.

More sophisticated data models deploy algorithms to assign specific rent. These tools can be expensive to use. They may also not allow enough transparency for you to feel confident about the assigned rent.

Simplify your research

Rentometer PRO is a powerful tool that eliminates the tedious, time-consuming steps in the DIY approach. A Rentometer PRO report provides comprehensive rent guidance that is transparent and easy to understand. We recognize the importance of reliable, verified rental data to setting rent. We also understand that the data is only the starting point.

As a local professional, you already have a good understanding of local market conditions. You also know the strengths and weaknesses of your specific property. Data from Rentometer PRO adds a critical layer of information to your rent-setting process. A layer that complements your experience and market insight but by no means attempts to replace it.

Rent potential

You can use rent pricing information and guidance from Rentometer to confidently set your rents.

Here is a sample framework for evaluating your rental:

Rate your rental compared to nearby rentals and local market conditions using the following key variables:

- Location – "the location is: great, ok, not great?

- Unit size/sq. ft. – "the unit size is large, average, small?"

- Building age – "the building is new, old, or in between?"

- Building condition – "the building is in great, average, poor condition?"

- Amenities – "there are many, a few, or no amenities?"

Once the rental is rated for each of the key variables (and any other important variables), for simplicity sake, summarize the result with a single grade as follows:

- A = top of the market;

- B = above average;

- C = below average; and

- D = bottom of the market.

Once a grade is established, follow the suggested pricing guidance:

- "A - top of market" rental should use 75th percentile and above

- "B - above average" rental should use median to 75th percentile

- "C - below average" rental should use 25th percentile to median

- "D – bottom of market" rental should use 25th percentile and below

Back to TopArticle 14.

Article 14.Top 3 Landlord Mistakes on Charging Rent

Top 3 Landlord Mistakes on Charging Rent

Author: Sam Kwak

Your rent is the blood flow of your business as a landlord. The heartbeat that keeps your business profitable. But it’s also essential to understand how to charge rental rates that keep your business profitable for the long term. I often run into landlords that either try to charge “too much” rent for their given market and more commonly, I see a lot of landlords who undercharge compared to their market. These two landlord mistakes equally stunt your business!

In this article, I’m going to share 3 FATAL landlord mistakes when charging rents.

1. Not Knowing their Comps

This is a typical mistake for most beginner landlords who just get started. Often, landlords will set up an arbitrary amount for their rent and think their property will rent just fine. The problem is that tenants are becoming more savvy and aware of the going rental rates in the area. Rental comps (or rental comparable) is simply assessing what other rental properties are charging for their rate. Taking into in consideration of quality, size, and similarity of the units. Make sure you’re comparing apples to apples. Meaning that you want to compare other properties with similar size, bedroom/bathroom counts, housing type, and unit quality.

Now, one thing I want to highlight is the unit quality part. Suppose your unit has a laminate countertop with standard quality cabinets. In that case, you’ll want to be careful of comparing it to another unit that may have a granite countertop with a set of higher-end cabinets. The unit with the granite countertop can charge more.

Another thing to consider is, will adding a granite countertop be appropriate for the market? If your unit is the only unit with a granite countertop, you’re putting yourself on the higher end of the quality spectrum in the market. In this scenario, you may have a slightly harder time renting your unit since most people expect to rent a unit without one and thus pay less. Think of yourself as the “Nordstrom” in an area where most people would shop at “Dollar Tree”. You’re going to see less demand for your unit because of the market fit and needs.

One of the best ways to get Market Comps is through Rentometer. This is a really simple online software that allows you to look up the average going rate. You don’t have to spend a lot of time comparing when you have a list of similar properties in your area.

2. Overcharging

This has to do with my first point where the landlords don’t quite understand how to run a rental comp. They might be in a situation where their unit is on the top of the quality spectrum. In this case, they’re looking to charge a lot of money for it. The problem is, this unit may not have the demand or able “buyers” that are looking for these types of units.

To see more about overcharging, undercharging and what you can do about it, click on read more.

Back to TopArticle 15.

Article 15.Median or Average Rent? Which Should I Choose for My Rental Property?

Median or Average Rent? Which Should I Choose for My Rental Property?

Author: Rentometer Content Team

When you learn how to set rent rates accurately, you will be well on the way to success as a real estate investor. The rent you collect provides the ongoing cash flow to cover the: mortgage, insurance, taxes, utilities, repairs, and other recurring expenses for your property. Plus, you need it to fund your reserve account and carve out a profit.

Determine how you will set your rental rate

The first step is to determine how you will set your rental rates. Many investors use the 1% rule: If the property is worth $100,000, they charge 1% of that value per month, which comes to $1000. This rule may not apply equally across all neighborhoods. If you have a home worth $500,000, it is unlikely that you will be able to charge $5000 for rent.

Examples of rent charged by other area landlords and investors also make a good place to start. Research what other landlords charge for a comparable property to find a base price range. You can then adjust the base price, depending on how your rental compares on a few factors – the property's condition, immediate location, and any updated amenities. A well-maintained property with better amenities in a nicer part of town will rent for a higher amount than the same size property in disrepair or one located in a less desirable part of town.

Real estate investors can also use online tools to inform how they set their rent. You could review rental listing websites to compile a list of properties similar to yours and look up the locations. Calculate an average rent and determine whether your property's characteristics put it above or below a typical property on the market.

Consider an online rent evaluation tool that will compile rent data and more.

Rentometer is an online rent evaluation tool that searches all the major online listing sites like Craigslist daily to pull current rental listings into one database. You can then enter search criteria, and Rentometer will find the properties that match your criteria and calculate a "Rentometer" range for low, medium, and high rent.

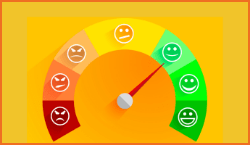

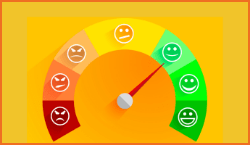

Rentometer's Quickview report will show you if your rent is reasonable for the area. Reasonable rent is when it falls into the range shown in the green section. If your rent shows up in the red section, it's likely overpriced for the area. The middle white section shows the area's median rate: 50% of area rents run below that rate, and 50% run higher.

The Quickview report also graphs the lowest 25%, the median, the average, and the highest 75%. Depending on your property's amenities, condition and location, you can adjust your rental rates accordingly.

What is the difference between median and average rent?

If you're new to an area or looking for tenants to lease your out-of-town rental property; you may want to default to a rent rate at either the median or average rent and see if you attract applicants. But when choosing either median or average as your point of reference, what's the difference?

Click on read more to find out.

Back to Top